ATTENTION: MORTGAGE BROKERS THAT WANT TO ACCELERATE THEIR GROWTH

Compound Your Loan Volume & Scale Your Brokerage Faster By Installing BrokerFlowPro, Maximising Your Efficiency & Profit To Focus On Scaling Your Business

...Without Hiring Expensive In-House Staff, Compromising Compliance, Or Wasting Time Trying To Manage Freelancers

The Trusted Back-Office Solution Built For Compliance & Speed, Exclusively For Australian Mortgage Brokers To Free Up 10-20 Hours a Week, Eliminate Admin Bottlenecks, Streamline Workflows & Focus On Growth

Free Yourself From Admin To Focus On Revenue-Generating Activities — Book Your Free Discovery Call To See How BrokerFlowPro Can Transform Your Brokerage

This call helps us understand your current workflow and be able to prescribe an optimal mortgage support specialist and system that’s actually tailored to you.

We Build Powerful Mortgage Broking Support Systems For You…

Implement The Exact BrokerFlowPro Process That Has Freed Australian Brokers From Backend Admin, Built Specifically To Scale Your Loan Volumes Without Growing Your Payroll

Your brokerage needs a proven support system you can trust that seamlessly handles compliance, document preparation, and client follow-ups — so you can focus 100% on revenue-generating activities and growing your business without the stress or risk of unreliable outsourcing.

Here’s Exactly What We Build For You:

Your Streamlined Admin & Compliance Workflow

We map every step of your current admin and compliance process with our BrokerFlowPro Precision Onboarding.

Unlike generic outsourcing, this step is engineered exclusively for Australian mortgage brokers, ensuring your workflow is documented in detail and optimised to remove bottlenecks.

The result? You reclaim hours each week to focus on client meetings and growing your loan pipeline, confident that nothing critical will slip through the cracks.

Your Dedicated, Industry-Trained Mortgage Support Specialist

We don’t gamble with freelancers.

Your support specialist is handpicked from our pool of certified mortgage processing specialists who have completed the BrokerFlowPro Certification Program covering Australian lender systems, compliance standards, and client confidentiality protocols.

This means you get an assistant who understands your world from day one—reducing onboarding time and eliminating costly errors that stall revenue growth.

Your Shadowing Process & Zero-Risk Training

Before your specialist goes live, they shadow your daily processes under the supervision of our Operations Manager.

You’ll receive daily progress reports and approve each workflow before handover.

This structured approach guarantees transparency, builds your confidence, and ensures your support assistant is ready to deliver high-quality work without disrupting your business or requiring endless training.

Your Fully Managed Back Office Support System

From loan application packaging to settlement tracking and client follow-ups, we install a comprehensive back office support system that frees you to focus solely on revenue-generating activities.

Every task is managed through clear SOPs and overseen by our Australian-based Client Success Manager, so your business keeps moving even when you step away.

Your Ongoing Optimisation & Scale Plan

Once your specialist is live, we don’t disappear.

We hold consistent regular check-ins and ongoing performance reviews to ensure continuous improvement and identify opportunities to scale your support.

As your brokerage grows, BrokerFlowPro flexes with you—so you can increase capacity and income without hiring more local staff or adding more stress to your plate.

From the Desk of

Rachel Johnson

Outsource Workers Australia

Mortgage Broker Support Manager

The biggest problem mortgage brokers face that keeps them trapped in a cycle of stress, long hours, and stalled growth?

A crippling administrative burden.

With countless tasks piling up — compliance paperwork, document follow-ups, CRM updates — it’s nearly impossible to find the time to meet more clients, write more loans, and actually grow the business you’ve worked so hard to build.

Over the years, I’ve seen it repeatedly…

Talented brokers with every intention of scaling end up buried in admin, sacrificing evenings and weekends just to keep up.

The reality? It’s not your fault.

You’ve probably tried hiring casual admin help, outsourcing to freelancers, or purchasing generic virtual assistant services — only to be left with more stress, inconsistent results, and the constant fear that something critical will slip through the cracks.

The reason these approaches never deliver real transformation is simple:

They don’t solve the root problem.

You don’t just need help — you need a proven system designed specifically for Australian mortgage brokers.

From documenting your exact workflows in detail, to training your specialist in Australian lender platforms, to supervising a structured shadowing period before they ever touch a live file…

That’s where we’re different.

We don’t send you a random assistant and hope for the best.

We install the BrokerFlowPro Precision Onboarding System, so you can reclaim 10–20 hours per week without sacrificing control or quality.

We know how to build a back-office operation that runs like a well-oiled machine.

We know how to protect your reputation and your clients with strict compliance and data security.

And we know how to free you up to focus exclusively on revenue-generating activities — the part of your business only you can do.

This is exactly how dozens of brokers have transformed their operations into scalable, stress-free businesses…

…and it’s how you can too.

"We Install This Proven Mortgage Broking Support System Seamlessly Into Your Business, For You"

You don’t have to waste precious hours figuring out what works and what doesn’t when it comes to freeing yourself from overwhelming admin.

Streamlined back-office operations are our area of expertise — and we handle the entire setup for you, so it’s effortless on your end.

This unique system maps every compliance, admin, and client management step upfront, so your specialist hits the ground running without the usual frustrations, costly mistakes, or endless hand-holding.

You could spend months trying to piece together generic outsourcing solutions and service quality…

Or you could shortcut this process by leveraging specialists who understand your industry inside out — and have already built the infrastructure you need to scale smoothly, simply, and with minimal effort...

...So you can focus on the high-value activities that drive revenue and grow your business.

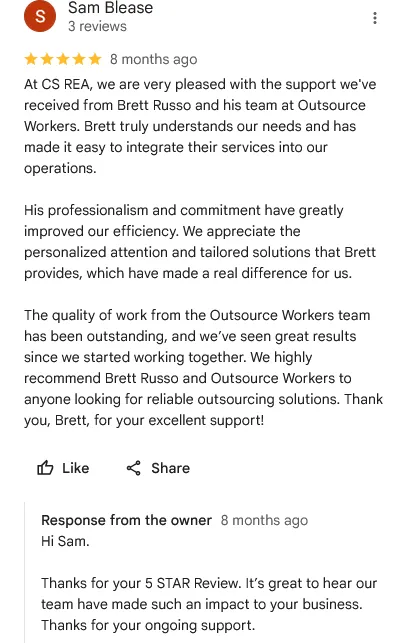

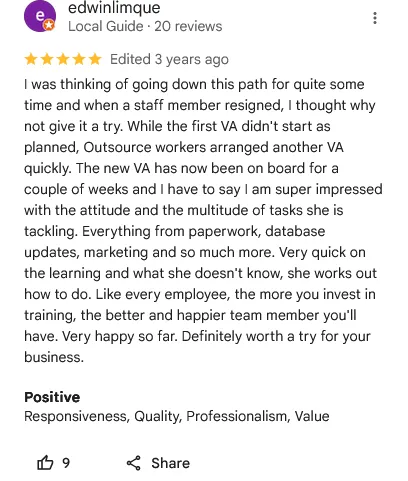

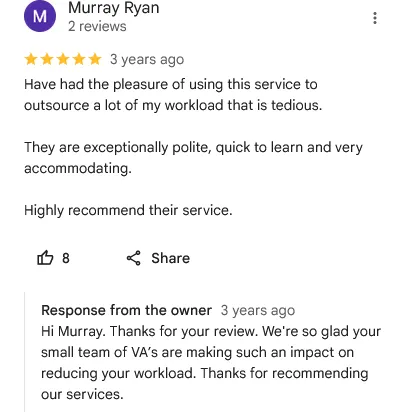

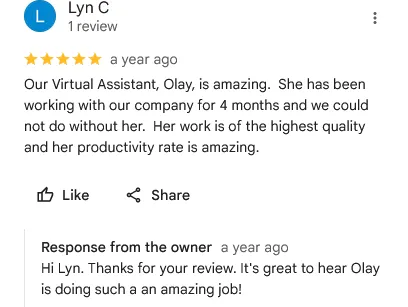

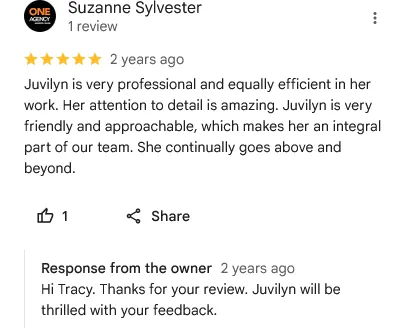

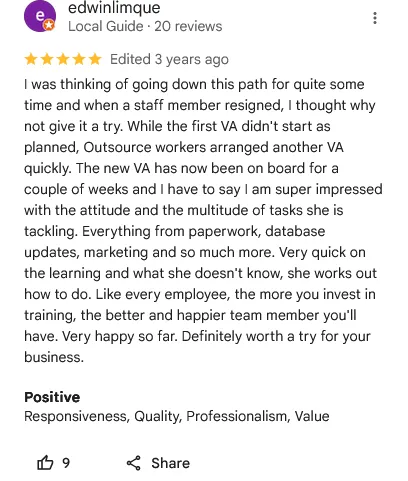

But Don't Just Take Our Word For It....

Execution Case Studies

Saved 18 Hours Per Week and Doubled Loan Settlements In 90 Days

This Melbourne-based solo mortgage broker was spending most of their time chasing compliance paperwork and updating CRM records, leaving little capacity to meet new clients or nurture referrals.

We implemented the full BrokerFlowPro Process, starting with Precision Onboarding to document every admin and compliance step. Within two weeks, their dedicated, certified support specialist was seamlessly handling loan packaging, settlement tracking, and client follow-ups.

The result? 18 hours per week reclaimed for revenue-generating activities. In just 90 days, they doubled their settled loans and achieved record-high monthly commission income.

This transformation was possible because our process removes the guesswork and risk that come with hiring generic admin help.

We Personally Leverage The Exact BrokerFlowPro System We Install For You

We use BrokerFlowPro in our own operations to manage client onboarding, compliance, and workflow tracking.

Every step — from Process Mapping to structured Shadowing and Go-Live — has been battle-tested in our business before we ever deploy it in yours.

This ensures you’re not just accessing theory; you’re tapping into a proven system that has helped us scale without compromising quality or client experience.

When you book your Discovery Call today, you’ll see exactly how the process works behind the scenes — and why it empowers brokers to free up time, reduce stress, and grow faster without hiring expensive local staff.

"Free Up 10–20 Hours Per Week To Grow Your Brokerage With A Proven Support System Built For Mortgage Brokers"

The key to scaling your business is having the time and capacity to focus exclusively on revenue-generating activities.

With BrokerFlowPro, you’ll leverage a proven, industry-specific system deployed into your brokerage in just 30 days.

We eliminate the guesswork by installing our Precision Onboarding Process — a structured method designed to integrate fully trained, compliance-ready mortgage support specialists who can handle your entire back office.

This means you can finally step away from admin bottlenecks and spend more time meeting clients, writing loans, and growing your income.

Learn How To Reclaim 10–20 Hours A Week And Scale Your Brokerage With A Fully Managed Support System

Unlock more time to grow your business by leveraging a proven, industry-specific system that removes the admin burden entirely.

With BrokerFlowPro, you’ll install a dedicated, compliance-trained support specialist into your workflow through our unique BrokerFlowPro Precision Onboarding Process — the only onboarding method engineered exclusively for Australian mortgage brokers.

This ensures your back office runs seamlessly, giving you the freedom to focus on meeting clients, writing more loans, and scaling your revenue without stress or costly trial and error.

The BrokerFlowPro Precision Support Process

Mapping Your Workflow For Maximum Efficiency

The first step is our Strategy & Fit Call, where we unpack your current admin, compliance, and client management workflows in detail.

This lays the foundation for freeing up your time to focus on growing your business.

We identify exactly where you’re losing hours and design a plan to redirect that capacity into revenue-generating activities.

Precision Onboarding Built Exclusively For Brokers

Unlike generic assistant services, we implement the BrokerFlowPro Precision Onboarding Process.

This includes a comprehensive Process Mapping Session and Task Prioritisation Workshop to ensure no detail is overlooked.

This unique mechanism is what guarantees a seamless integration of your new support specialist without disrupting your business or compromising compliance.

Selecting And Certifying Your Dedicated Support Specialist

We don’t just match you with any assistant.

Your mortgage support specialist is handpicked from a pre-certified pool trained specifically in Australian mortgage workflows, lender platforms, and ASIC compliance.

This ensures they are ready to deliver high-quality work from day one, giving you the confidence to step away from admin and focus on growth.

Shadowing & Zero-Risk Handover

Before going live, your specialist completes a structured shadowing period under supervision.

You’ll receive daily reports and review all tasks before approval.

This process builds trust, mitigates risk, and ensures your operations keep moving smoothly while you regain time for client acquisition.

Scaling & Continuous Optimisation

Once your specialist is live, we conduct weekly check-ins in the first month and monthly workflow reviews to keep improving efficiency.

As your brokerage grows, your support scales flexibly, enabling you to meet more clients, settle more loans, and enjoy consistent revenue growth without ever increasing your payroll burden.

Client Results:

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

How do I know my support specialist will understand Australian mortgage processes?

Every BrokerFlowPro™ specialist completes a rigorous 6-week certification programme covering Australian lender platforms, ASIC compliance, Best Interests Duty, and local terminology. Unlike generic outsourcing, our process ensures your support specialist is fully prepared to handle complex loan files to a professional standard from day one.

How long does it take to get started?

Your support system is typically up and running within 30 days. We start with a Discovery & Fit Call, move into Precision Onboarding to map your processes, then select and train your dedicated specialist before the structured shadowing phase.

What tasks will my specialist handle for me?

Your support specialist can manage loan application processing, compliance documentation, CRM updates, client follow-ups, email and calendar management, settlement tracking, and more — freeing you to focus on revenue-generating activities.

How do you ensure the confidentiality and security of my client data?

Data security is non-negotiable. All specialists are trained in strict confidentiality protocols, and we use secure systems for document management. We also provide NDAs and can accommodate additional compliance measures if needed.

Will I have to train my support specialist myself?

No. Our unique Precision Onboarding Process includes pre-training on your backend systems. There may be some guidance required on any specific internal processes within your business, otherwise you simply review and approve their readiness after the shadowing phase.

What if I’m not satisfied with my specialist’s performance?

We provide weekly check-ins during the first month and ongoing monthly reviews to ensure quality. If you ever need adjustments, your Australian-based Client Success Manager is on hand to resolve issues promptly.

Can my support scale as my business grows?

Absolutely. BrokerFlowPro™ is designed to be flexible and scalable. You can increase your support capacity or add additional specialists as your loan volume grows, without the overheads of hiring in-house staff.

How much time will this save me each week?

On average, brokers save between 10 and 20 hours per week, which you can reinvest into meeting clients, writing loans, and expanding your pipeline.

What makes BrokerFlowPro different from hiring a freelancer or using a marketplace VA?

We work exclusively with Australian mortgage brokers. Every support specialist is pre-certified, embedded in a structured process, and fully managed by our local support team. This eliminates the risks of poor training, disappearing freelancers, and inconsistent results.

Is there a long-term commitment?

No. We offer flexible packages with no long-term lock-in contracts. You can start with a no-commitment pilot and scale up or down as your needs evolve.

© Copyright 2025 Outsource Workers. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms